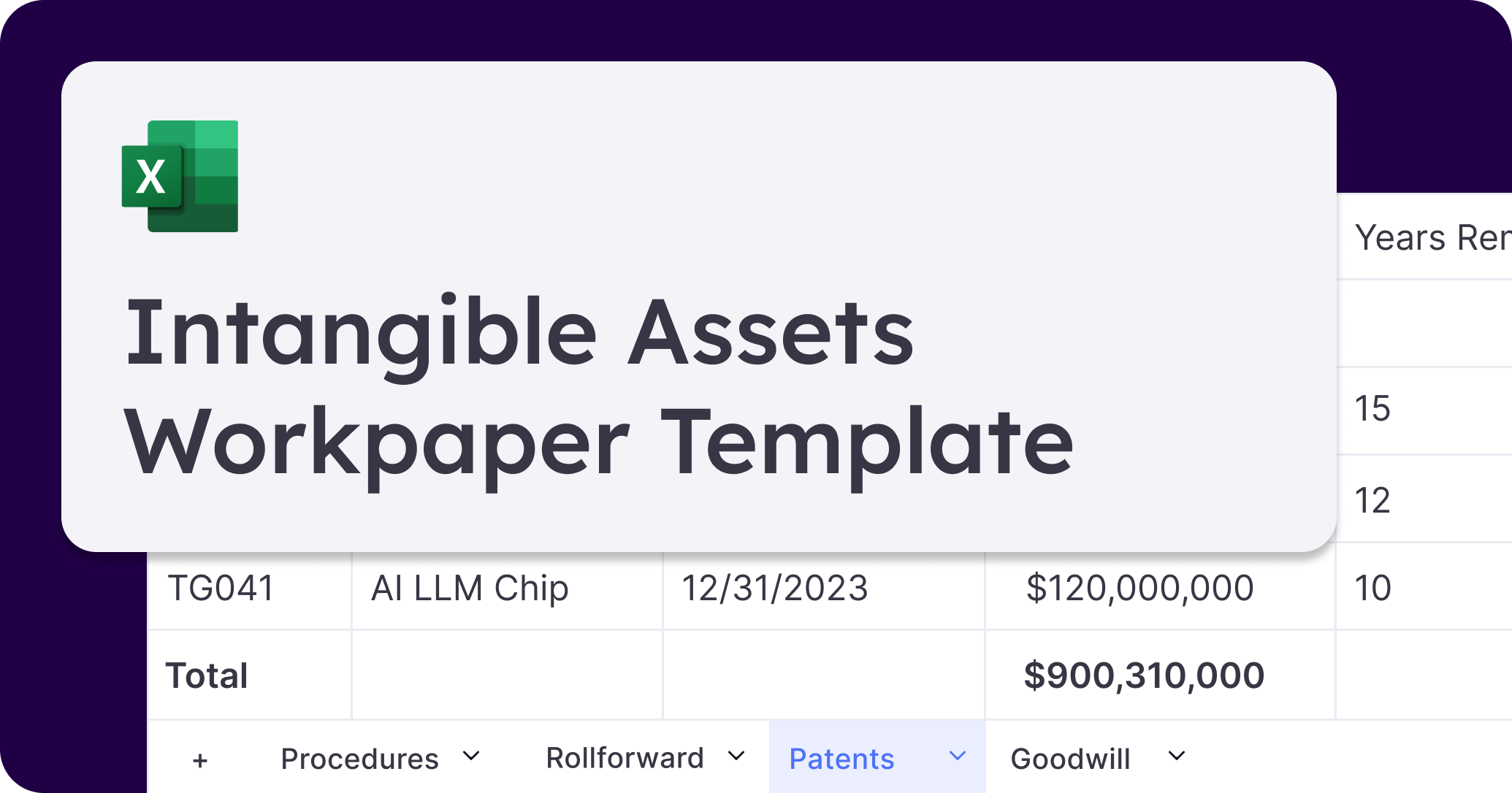

Intangible Assets Reconciliation Template Overview

Who is it for:

- Accounting and finance teams in organizations that have intangible assets and need to monitor, reconcile, and report on these assets over time.

- Finance professionals aiming to streamline the reconciliation process and maintain accurate records of intangible assets.

How do you use it:

- Procedures: Document and follow the outlined steps each month to ensure a consistent and thorough reconciliation process.

- Rollforward: Adjust the date as needed and input the intangible assets data to track changes over time.

- Amortization: Fill in details related to intangible assets, including vendor names, total amounts, and set the amortization schedule.

- Journal Entry: Record relevant journal entries for intangible assets, including date, amount, and description.

- Trial Balance: Monitor the monthly balances for the intangible assets account to ensure precision and consistency.

Why should teams use it:

- Efficiency: Simplify the reconciliation process, decrease manual effort, and ensure that intangible assets are accurately recorded and reported.

- Accuracy: Reduce errors and discrepancies by adopting a structured approach to reconciling intangible assets.

- Transparency: Offer clear insight into the intangible assets account, promoting informed financial decisions.

- Audit Trail: Keep a thorough record of all activities concerning intangible assets, crucial during audits and evaluations.

Why teams should use a close management solution

- Efficiency: Close management software optimizes the process by calculating business day due dates, adjusting for holidays, sending automated reminders, and orchestrating complex financial workflows. This results in faster closing times, quicker financial reporting, prompt decision-making, and a more contented team.

- Visibility: The software ensures all members are aware of their roles, tasks, and deadlines. It promotes information sharing and task coordination. Real-time dashboards and reporting tools offer managers an immediate overview of the process, pinpointing any delays or upcoming tasks for swift, informed decisions.

- Collaboration: The platform allows for easy tracking of comments, review notes, and evaluations, reducing the reliance on lengthy email exchanges and encouraging a culture of openness and teamwork.

- Accuracy: By consolidating and harmonizing the close process, the risk of human errors diminishes, resulting in more accurate financial data. It enables quick identification and resolution of issues.

- Control: Close management software, rooted in best practices, enhances the team's compliance with financial reporting norms and regulations. The system logs a detailed audit trail, indicating all activities, invaluable during audits and regulatory assessments.

%20(4).png)

%20(3).png)

%20(1).png)