Ask 100 accountants to define what is and what isn’t involved in the month-end close process and you’ll get nearly 100 unique responses.

We’d know. Our team talks to accountants every day and have run straight into the realization that there isn’t a shared definition of what’s involved in the month-end close process.

So we’re putting a stake in the ground and are sharing how our team (informed by hundreds of conversations on the month-end close) practically thinks about the boundaries of the month-end close.

And it’s a bit more complicated than the flashcard definition you studied years back.

What is the Month-end Close Process? (By the textbook)

Here’s the definition that you probably read in textbooks on what is the month-end close process:

“The month-end close process involves recording and reviewing all financial transactions in the past month.”

And like most of what you learned from a textbook, that definition falls flat when facing reality on the ground.

Let’s face it — your team has limited bandwidth. And like most teams, the laundry list of what everyone should be doing on a monthly basis shifts to quarter-end or year-end closes.

Recording and reviewing “all financial transactions” is, in most cases, unobtainable.

Included In The Month-end Close or Not?

Case in point, let’s start with some basic accounting procedures. Go ahead and ask a group of accountant friends, which of the below are included in their month-end process?

- Recording stock compensation

- Recognizing revenue

- Depreciating fixed assets

- Identifying software capitalization

All of the above? Some of the above? The standard definition doesn’t really give us actionable advice on what really is the month-end close for most businesses.

So here’s how we think about it.

Our Definition of The Month-end Close Process

The month-end close process delivers your team accurate and actionable financial data from the preceding month to inform business decisions and adhere to control requirements.

Typically, this involves three steps: data is entered into the system, reconciled properly, and then reviewed to flag anything that may be incorrect.

The finish line of the close process is when the data is locked and ready for reporting, analysis, etc.

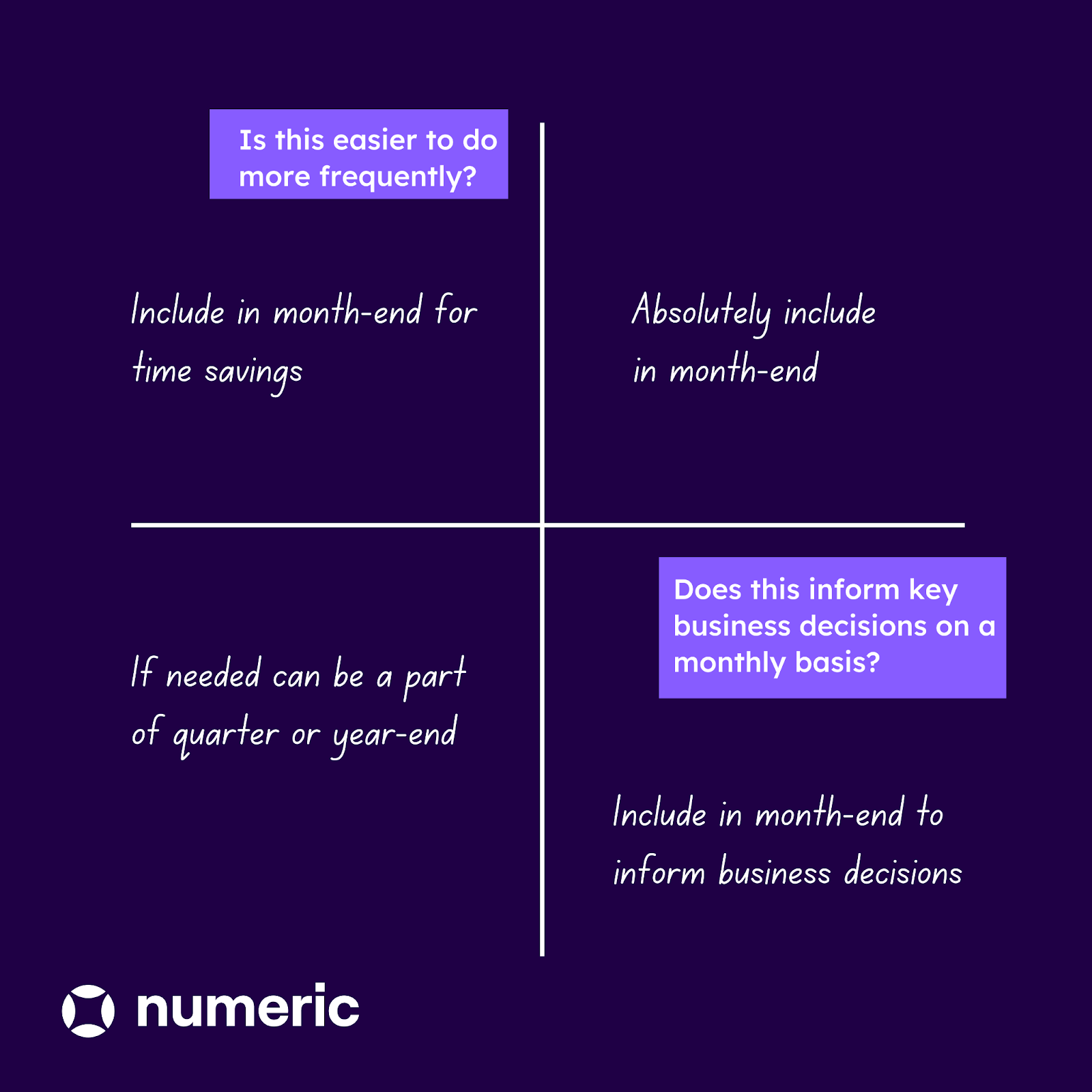

So taking into account the operating words in our definition of accurate and actionable, we use a two-question framework for determining if something should be in the month-end close or if it’s just fine pushing out to quarter or year-end.

- Does this inform key decisions being made on a monthly or more frequent basis? Is it actionable

- Is this actually much easier to do frequently? Often due to high transaction volume (think bank recs)

With this framework, all things cash flow and cash burn related immediately jump out as clear month-end close must-haves. But what else is then required in the month-end close process?

Let’s return to our above, slightly more nuanced, examples and see where they fit in:

Example: Revenue Recognition

This one is the most straightforward. Whether you’re an early stage start-up or you’re a public company, revenue certainly drives business decisions.

Big yes to the first question in our framework and absolutely a part of a complete month-end close.

Example: Depreciating Fixed Assets

First question, “Does this inform key decisions being made on a monthly or more frequent basis?”.

In many cases, fixed assets are low enough in volume (think for a remote SaaS company) that it may not be material to include in the month-end process when considering business decision impact alone.

But, think of the second question, “Is this actually much easier to do frequently?”. The further that time passes, the more challenging it is to round up the right information (serial numbers, cost, etc.) of fixed assets.

Accounting for fixed assets during the month-end close makes life easier in the long-run. So yes, for most companies it’s a part of a quality month-end close process.

Example: Recording Stock-based Compensation

For many businesses, stock-based comp is low enough in volume that month to month the relevant financial data isn’t being used to drive business decisions. So no to our first question.

And compared to accounting for fixed assets or prepaid expenses, it’s not too challenging to address stock-based comp at quarter-end — much of the necessary information is likely housed in Carta or a similar tool.

So, according to our framework, if you’re a skeleton accounting team trying to create a manageable month-end process, we’d argue that addressing stock-based comp at quarter-end instead of month-end may be the right balance of accuracy and efficiency.

But there’s one more complicating factor to keep in mind.

The Boundaries of The Month-end Close Expand Over Time

You’ll notice our definition of the month-end close process critically includes “adhere to audit requirements”.

When using our two question framework to think through when to perform accounting procedures, naturally the last key element is taking into account audit requirements for your organization.

For an early-stage start-up or small business, a complete month-end process will include fewer steps and key accounts — both as a function of the more narrow set of questions you’re asking of your accounting data and the less intensive audit requirements.

Companies on the brink of an IPO, on the other hand, will have a much heftier close checklist come month-end.

Tasks that were previously done at quarter-end, like the stock comp example given above, are brought into the month-end close process.

This dynamic is much of what makes comparing close timelines across companies so challenging.

(And yes, this is permission to ignore your braggadocious CFO friend opining about their 3 day close every time you grab dinner)

Now, a Tricky One: Is Flux Analysis Included In the Month-end Close?

Flux analysis is particularly divisive.

As teams use Numeric to easily perform flux analysis on their underlying ERP data, we’ve seen firsthand that some folks include flux squarely as a month-end close activity and others situate it as a post-close task.

Our take: it depends on why you’re doing the flux.

Is flux analysis helping your team ensure accurate, actionable financial data?

If flux is used to pinpoint missing accruals or ensure completeness, verdicts in: it’s a part of the month-end close process.

Instead, if flux is an analytical procedure that’s more about providing commentary and reporting: it’s squarely a post-close activity.

Bottom Line on The Month-end Close

Determining the right month-end process is largely about striking the right balance between speed and accuracy.

And what’s included in month-end versus year-end or quarter-end, is context dependent, dictated by transaction volume, how financial data is used, and your company stage.

While the exact set of steps will differ, across all businesses, the north star of the month-end close should be a set of processes that guarantee the delivery of accurate and actionable financial data.

Working towards a faster, more accurate month-end close? Start for free organizing and adding visibility to your close process with Numeric Essentials.

.png)

.png)

.png)