FloQast is one of the three main players in the financial close management process, together with BlackLine and Numeric. FloQast offers a month-end close checklist and functionality for managing aspects of the close process, like reconciliation and flux analysis, for accounting teams.

What Is FloQast?

FloQast is a financial close management software that helps teams manage their month-end close process.

FloQast was founded in 2013 by Mike Whitmire, Chris Sluty, and Cullen Zandstra and has its headquarters in Sherman Oaks, CA. Over the past decade, the platform has gained a position as one of the leaders in the accounting software industry, along with BlackLine and Numeric.

The FloQast approach to financial close management focuses on helping teams that enjoy working in Microsoft Excel or Google Sheets stay within spreadsheets while organizing the month-end close with a checklist.

Related Reading: How to Build the Best Month-End Close Checklist

Why Do Teams Use FloQast?

Accounting teams use FloQast - and similar close management tools - for two main purposes: 1) to be organized come month-end and 2) to be audit-ready.

First, implementing a good close management tool can help tame the chaos of the month-end close and add visibility to the process. With a clear checklist, your accounting team knows exactly what is happening and when during the month-end close.

Better collaboration between team members improves transparency and accuracy and real-time display of progress guarantees that your close is efficient and on-time.

Second, with the help of financial close software like FloQast, teams have access to all controls, critical steps, and commentary in a single place, which makes them ready for annual audits. Audit season is no longer a nightmare as teams have an organized, systemized record. The comprehensive trail of all activities ensures no hiccups during audit through full transparency and accountability.

Related Reading: How Long Should Your Month-End Close Take?

FloQast Integrations with ERPs

FloQast integrates with the major ERPs/General Ledgers used by the vast majority of accounting teams.

FloQast integrations with ERPs include:

- Oracle NetSuite

- QuickBooks Online

- Sage Intacct

- SAP

- Infor

- Microsoft Dynamics

In addition, FloQast integrates with the following products, organized by category:

- Collaboration tools: Microsoft Teams and Slack for notifications

- Cloud storage solutions: Dropbox, Google Drive, Microsoft OneDrive, Microsoft SharePoint, Egnyte, and Box

- Workflow and financial reporting platforms: Workiva

Who Uses FloQast and What Types of Accounting Teams Is FloQast the Best Fit For?

The most common users of the FloQast software include controllers and their accounting teams, often CPAs, that manage the close process, most often at mid-market companies.

Generally, out of the three major players in the close management space (FloQast, BlackLine, and Numeric), FloQast works best for teams that are in search of a straightforward month-end close checklist with basic workflows to facilitate the financial close process.

For teams looking more for close automation to eliminate manual work, enterprise-level BlackLine and more recent market entrant, Numeric, tend to be a stronger fit.

These two options focus heavily on reducing the need for manual tasks, providing sophisticated reporting, and offering additional functionality, albeit in different ways, discussed below.

How FloQast Works

Getting started with FloQast takes an average of 1.3 months.

FloQast works in the following way:

- Set up your chart of accounts and account mapping to allow FloQast to understand the required organization and categorization of financial accounts and transactions.

- Set up your month-end close checklist including all close tasks such as reconciling bank statements, reviewing journal entries, and preparing financial statements.

- Integrate FloQast with your ERP in order to import necessary financial data. Note: FloQast carries over typical account level details from ERPs, for teams that would benefit from deeper transaction-line information, consider FloQast alternatives.

- Integrate FloQast with existing workpapers in Microsoft Excel or Google Sheets.

What Products Does FloQast Offer?

FloQast provides a number of products to help with the month-end close checklist as well as basic functionalities related to close management.

FloQast features include:

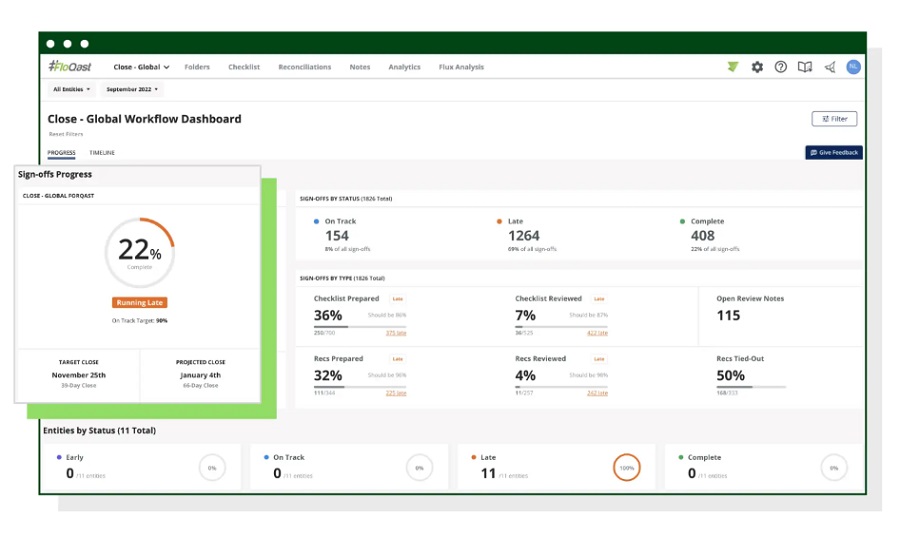

- FloQast Close: FloQast brings the management of all tasks necessary for the month-end close process for accountability, accuracy, and collaboration between relevant team members. The FloQast Close product provides task status updates, collaborative close checklist, and organized review notes.

Close faster for free with Numeric

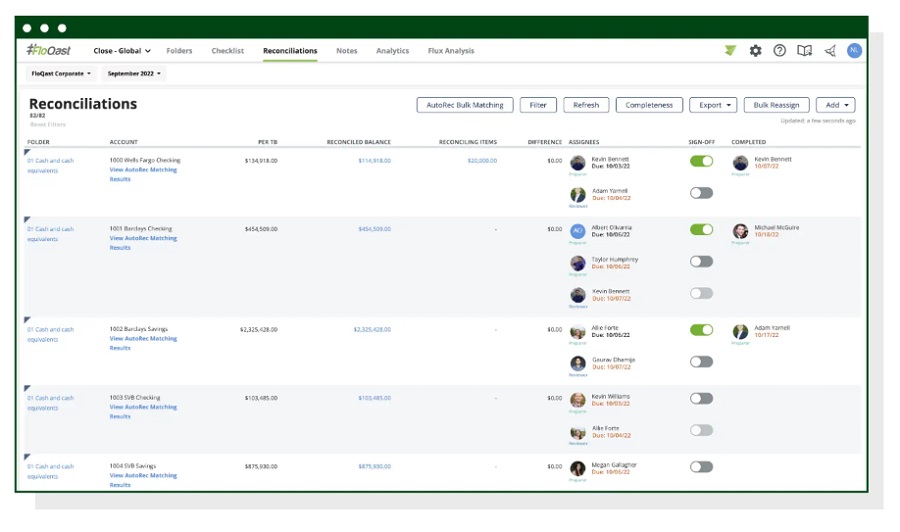

- FloQast Reconciliation Management: FloQast helps accountants manage financial reconciliation. FloQast Reconciliation Management offers a centralized view of account-level reconciliation status and tie-outs, automated transaction matching for various accounts, and recording and tracking reconciling items.

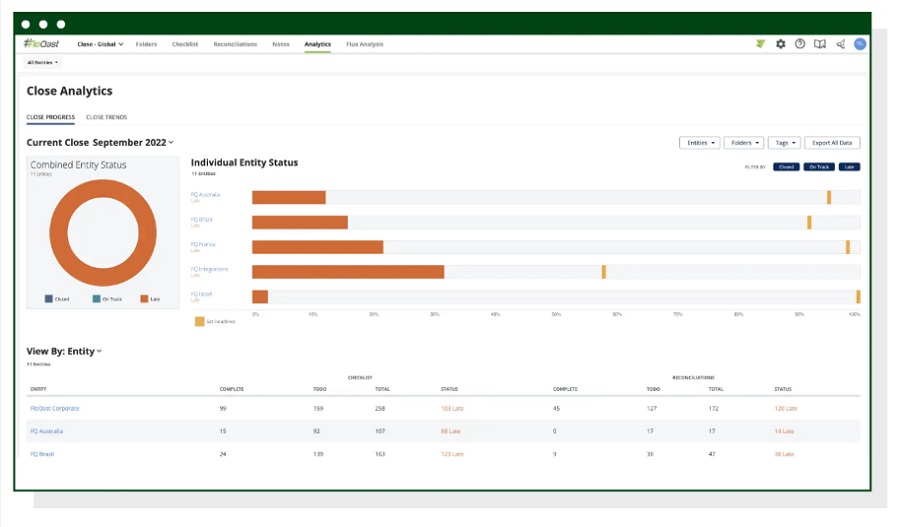

- FloQast Variance Analysis: FloQast VarianceAnalysis creates reports according to thresholds and assignments and allows users to assess variances from prior periods and compare final account balances to budgetary amounts for variances.

- FloQast Analyze: FloQast visualizes the month-end close process. FloQast Analyze provides a single-page summary of progress on close completion against set deadlines, basic accounting operations, and allows one to filter data by process, custom tags, checklist, and prepared items.

- FloQast Compliance Management: FloQast embeds controls in the financial close. With FloQast Compliance Management, you can capture financial controls during daily tasks, automate the synchronization of RCM to process narratives and flowcharts, improve PBC processes, and define and execute testing plans.

- FloQast ReMind: FloQast reduces the time needed for manual follow-up between team members by helping automate emails. FloQast ReMind sends automated reminders for expense reimbursements, task confirmations, and information requests with predefined or custom templates.

In summary, FloQast close features are centered around improving the task management process, automating communication, and enhancing visibility on progress towards monthly close for relevant team members.

FloQast Common Use Cases

To fully understand what FloQast is and how it works, it’s helpful to consider the most common use cases for the product.

FloQast is typically used for:

- Close checklist organization

- Account reconciliations

- Flux analysis

Close Checklist Organization

FloQast month-end close checklist organization facilitates the close process by smoothening the workflow process and securing collaboration.

FloQast Close helps build a financial close checklist using predefined or customized templates that can be shared with needed team members.

Account Reconciliations

With FloQast Reconciliation Management, teams can select the method and strategy that are most appropriate to reconcile each account type and integrate necessary spreadsheets.

Flux Analysis

With FloQast Variance Analysis, teams identify major discrepancies in balances. Some of the key features of this product include flexible comparison periods (month-over-month, quarter-over-quarter, and year-over-year), ability to set your own thresholds (as a percentage or a fixed amount), customizable account groupings, and explanations at account and group levels.

FloQast Reviews

When evaluating whether FloQast is the right fit for the needs of your team, it’s important to consider what those who are already using the software think about it through online reviews.

Most customers have given FloQast 4- or 5-star reviews on G2, one of the most reliable software review websites.

- G2: 4.7/5 stars

On the positive side, satisfied customers enjoy the simplicity of the platform, the potential to streamline many aspects of the workflow, and the real-time overview of task status. Customers also like the collaboration functionalities, the available customer support and customer success team, and the ability to save time.

On the other hand, this simplicity can come at a cost as many customers find the software to be rather limited in terms of accounting workflow automations, the control environment, and integrations with other tools.

Also, customers consider certain functionalities - such as adding items - to be cumbersome and flux analysis to not be dimensional enough as you cannot see previous periods or report by department. In addition, some companies think that the software is too expensive given the primary functionality of task management.

What Are Alternatives to FloQast?

BlackLine and Numeric are the most popular FloQast alternatives. Typically, they are used by accounting teams that want to organize the month-end close accounting processes while also taking a lot of repetitive, manual, time-consuming tasks off their plate.

Numeric

Numeric is the up and comer in the close management space, growing fast and incorporating AI from Day 1. Typically teams on Numeric choose the tool to go beyond a month-end checklist and reduce intensive manual work.

Specifically, Numeric pulls in every transaction line from ERPs every minute, enabling fast reporting, pinpointing exact transactions resulting in accounts not reconciling, and facilitating searches from underlying transaction data.

Numeric is also the only product on the market that offers a free plan to get started. With Numeric Essentials, you can implement close management, identify bottlenecks, automate emails, and benefit from an AI technical accounting assistant for free.

To get started with Numeric, you can sign up for the free Essentials plan or schedule a demo with the team to learn more about reconciliations and flux analysis.

BlackLine

When comparing FloQast vs BlackLine, the latter stands out as a good fit for teams that are looking for a powerful option for managing the month-end close and that have the capacity to allocate the necessary budget and staff.

BlackLine provides more opportunities for automation, including automated journal entry tracking, accounts receivable automation, and intercompany financial management.

However, BlackLine is one of the priciest solutions on the market, with multiple one-time fees and recurring costs. Moreover, implementation timelines may be lengthy and require a full-time administrator.

FloQast Pricing

The FloQast website does not provide any information about the pricing of the software. Interested Controllers need to schedule a demo with the FloQast team to discuss their team and accounting needs to get a custom quote.

Third-party online sources discuss a few different tiers which aim to meet the needs of teams with different requirements. Pricing is a typical SaaS model and depends on the included features, number of users, and what ERP FloQast is integrating with. Typically, FloQast pricing includes a one-time implementation cost and annual subscription fees afterwards.

Some resources report that the annual fees start at $125 per month per user, when billed annually. Others report annual fees starting at $9,000-$12,000, depending on access to features and number of team members.

FloQast does not offer a free trial or a free version.

The Bottom Line on FloQast

As one of the three most commonly used close management software, FloQast helps teams build month-end close checklists and organize the task management process. FloQast is usually used for account reconciliations, close checklist organization, and flux analysis.

For teams that want additional power with accounting automation software, common alternatives are BlackLine for enterprises with admin support and Numeric, where teams can leverage AI and get started for free.

.png)

.png)

.png)