BlackLine is a popular cloud-based software that helps streamline, organize, and automate accounting processes.

For a full deep dive into BlackLine, read through our BlackLine review.

This article looks at available plans, one-time and recurring costs, what is included in each plan, and the details of the user agreement to help you decide if this is the right fit for the accounting needs of your team.

BlackLine Plans

The BlackLine platform offers access to a few products including financial close management, accounts receivable automation, and intercompany financial management— each product has its own plans.

In general, plan pricing depends on the access to specific tools and features within the product and the number of users.

In this article, we focus on the pricing of the BlackLine financial close management product that helps accounting teams manage and simplify their close process.

BlackLine Pricing

BlackLine has a subscription-based pricing model for ongoing access to the software, with fees paid on a monthly or annual basis. Annual subscriptions to BlackLine are likely to come at discounted rates compared to monthly plans. The number of user licenses also affects the cost, with extra team members adding more to the subscription fee.

In addition to the subscription fee, the company charges different professional fees for the services that it provides.

Specifically, BlackLine charges the following service fees outside of a typical SaaS subscription:

- Implementation cost: BlackLine charges one-time set-up fees to help companies implement the software and get started with financial close management.

- Configuration fees: Getting support in configuring the software correctly and starting on the right foot might incur additional charges.

- Integration costs: Integrating the product with other tools beyond ERPs raises the implementation price.

- Customization fees: Customizing options and getting access to additional features not included in the standard package will further increase the cost.

- Data migration costs: Migrating data from currently used accounting tools and platforms to BlackLine is charged additionally.

Beyond the list price, these additional fees and charges can significantly increase the price of BlackLine.

As for exact numbers, unfortunately, the BlackLine website does not provide any information on available subscription plans or additional costs. Online reviews of the product on third-party websites do not discuss the specifics of BlackLine pricing either.

To obtain more detailed understanding of the BlackLine costs, interested controllers and accounting managers can check out the following resources:

- Contact a BlackLine sales representative: You can schedule a personalized demo to learn more about the BlackLine product where you can also ask questions related to the BlackLine pricing. After providing details about the need and the size of your business, you can obtain a custom offer.

- Ask on online forums: You can visit online accounting- or software-focused forums where you can ask other participants who already use BlackLine how much they pay and what this cost covers.

Add-on BlackLine Costs

In addition to recurring subscription fees, BlackLine pricing includes different professional fees. Most of these fees are associated with the implementation, set-up, and configuration process, but some might relate to ongoing needs like support and training on new available tools and features.

As BlackLine rolls out new functionality each year, the new product items are typically offered at an additional cost. Thus, before getting started with BlackLine, your team should budget for potential increases year over year if you are interested in access to newer features.

Get started with Numeric, a BlackLine alternative, for free

BlackLine Accounting Software Terms and Contracts

Signing a legally binding written agreement is a must when it comes to the financial and accounting processes of your business. Before signing, it is crucial to understand the terms and conditions that come with working with BlackLine to be able to make a decision if this is the best option for the needs of your company.

Since a copy of the required contract is not provided on the BlackLine website, interested customers can refer to other options to learn about the BlackLine terms and conditions:

- Schedule a demo: You can use the BlackLine website to request a demo and then use the allocated time to ask your questions related to the BlackLine contract.

- Contact the support team: There are a few different ways in which you can get in touch with a BlackLine customer representative - by phone, via email, or by filling in an online form on the company website. You can request to see a copy of the agreement and ask any additional clarifying questions you have.

- Check out online customer reviews & online forums: You can read through online reviews on third-party websites to see what existing customers say about the terms of the contract.

- Talk to peer controllers and accounting managers: You can speak to other enterprises and accounting specialists you know that already use BlackLine close management.

- Consult with a legal advisor: You can talk to a legal advisor and also ask them to review the agreement from BlackLine to make sure that your company’s best interests are well protected, in line with industry standards.

Once you have obtained a copy of the BlackLine contract, here are the main clauses and terms that you need to review:

- Scope of services: First and foremost, it’s important to have a clear understanding of the exact services that you will get from BlackLine, from access to products, all the way to professional services like implementation, integration, training, and customer support.

- Access to products and tools: You should know the exact products and features that you will be able to use under this agreement, what customization options are available, and whether you get access to updates on existing products and newly released items.

- Pricing and payment terms: The contract needs to provide a detailed outline of the BlackLine pricing model, including all one-time and recurring costs as well as the frequency, time, and method of invoicing. It also should specify whether future changes in pricing plans will affect you as an existing customer.

- Duration term: You need to understand the duration of the agreement and whether it gets automatically renewed or you need to renew it each time.

- Cancellation policy: Educate yourself on what it takes to terminate the agreement should you not be fully satisfied with the services provided by BlackLine. You also need to know how much time you will have to switch to another solution if BlackLine terminates the contract.

- Privacy and security: Last but not least, you should make sure that BlackLine implements best practices needed to keep your personal data and information safe and secure.

What BlackLine Offers for the Cost

With the current BlackLine pricing model, teams get access to the following features:

- Account reconciliation: BlackLine account reconciliation provides standardized, yet customizable templates for reconciliation between workpapers and your general ledger, adjustable workflows, and auto-certifications below a specified threshold.

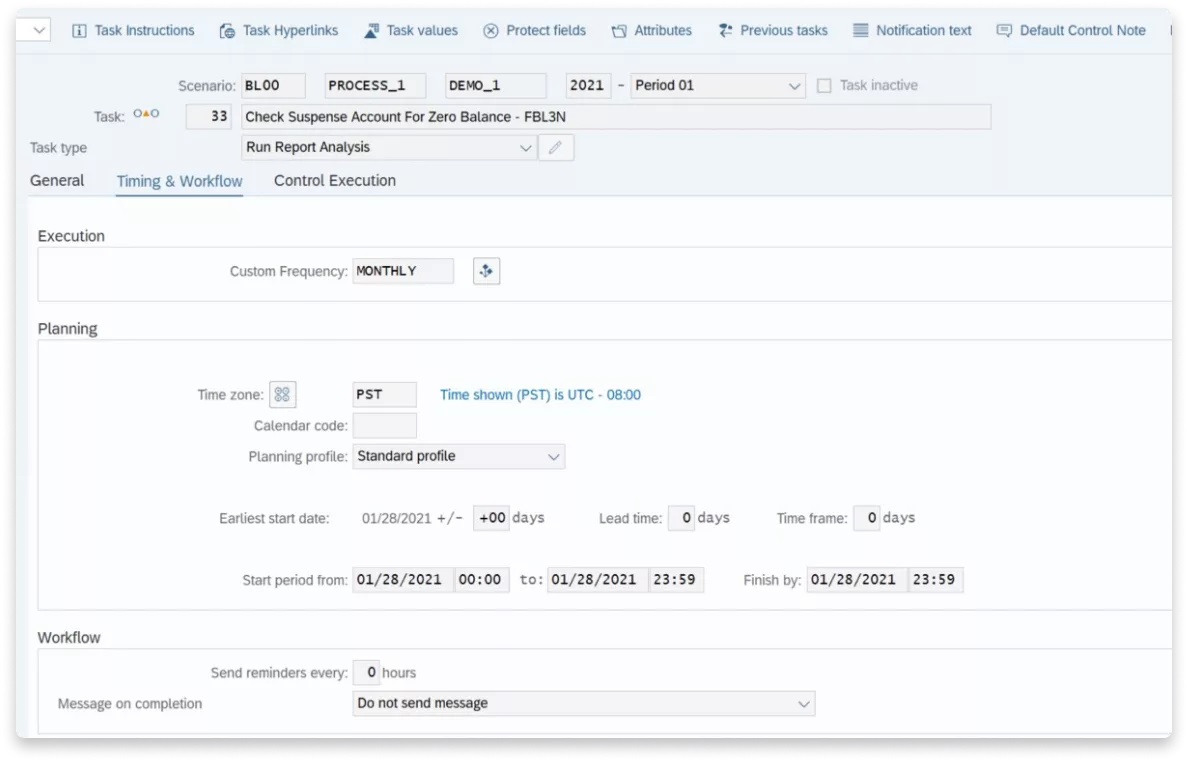

- Task management: Relevant team members can monitor, certify, and work together on various financial and accounting tasks with a clear audit trail.

- Transaction matching: Repetitive transactions can be matched and reconciled real-time so that human efforts are focused on the exceptions.

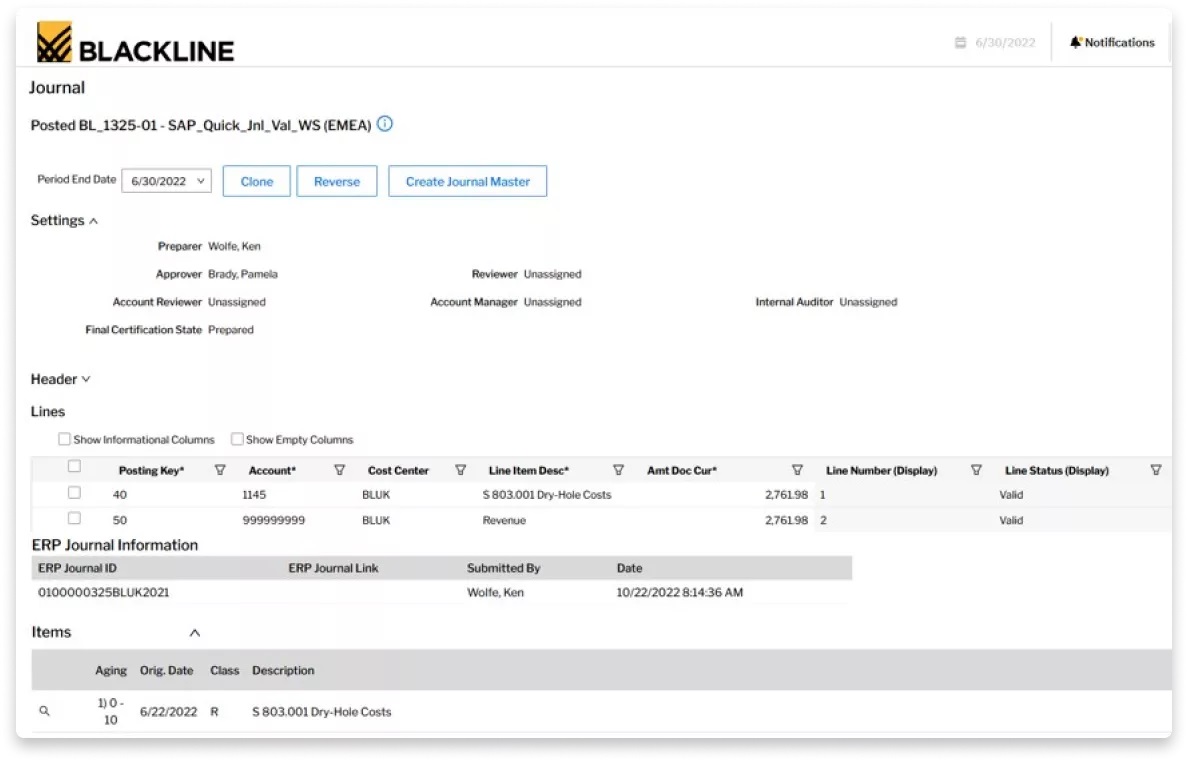

- Journal entry: Journal entry processes can be managed, centralized, and automated, with supporting documentation stored in the cloud.

- Account analysis: BlackLine assists in automating the examination of account balances of high-volume, high-risk accounts at the transaction level.

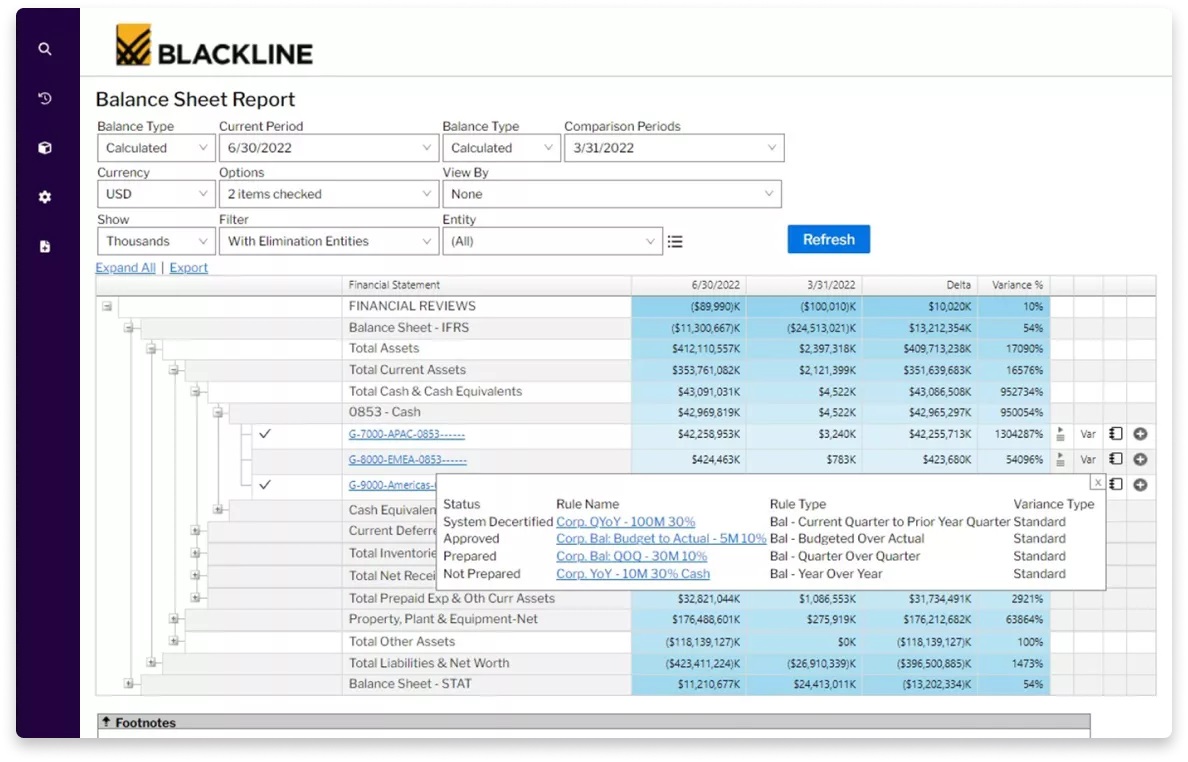

- Financial reporting analytics: You can streamline and optimize the processes of financial statement analysis.

- Variance analysis: BlackLine helps identify potential risks and discrepancies by calculating and highlighting fluctuations in activities and balances.

- Smart close for SAP: Teams can organize and improve activities related to the financial close process in SAP including scheduling tasks, monitoring activities, and verifying outcomes.

- Consolidation integrity manager: You can implement existing business rules for intercompany accounting and hierarchies in streamlining system-to-system reconciliations and mapping GL accounts.

- Compliance: Companies can manage risks and implement control workflows to ensure end-to-end compliance with internal policies and external requirements.

However, given the variety of possible plans, make sure that you outline which features your team needs and confirm that they are included in the pricing proposed.

Is BlackLine Worth It?

Considering BlackLine pricing and features, their month-end close management product can be worth it for large-scale enterprises including public companies, accounting firms with multiple clients, and some international organizations. It can be a great fit for entities that use SAP as their ERP software and that have complex financial and accounting needs and systems.

One of the main benefits which BlackLine offers is the high level of flexibility and customization. However, the downside of this flexibility is that it often comes hand in hand with at times time-consuming, human-resource intensive, and costly implementation and maintenance. In most cases, working with BlackLine requires dedicated staff to supervise configuration and provide ongoing support.

As a result, smaller teams with limited resources frequently report that they feel overwhelmed with the implementation burden associated with using BlackLine. Indeed, the steep learning curve can feel overpowering rather than empowering.

For these companies, Numeric, a BlackLine alternative, offers a comparable level of flexibility and in-depth reporting, yet accompanied by easy implementation, user-friendly interface, and a much less steep learning curve. Moreover, you can start enhancing and automating your financial close management process for free.

BlackLine Costs vs Competitor Costs

Before deciding whether to get started with BlackLine, it’s important to compare costs and fees with the pricing of alternative tools.

All in all, our review shows that the BlackLine pricing tends to be on the higher end in the financial close management software industry. This is one of the reasons that make BlackLine a potentially good option for large-scale enterprises that have not only the necessary human bandwidth but also the needed financial resources to implement, use, and maintain the platform efficiently.

Meanwhile, with Numeric, one of the top BlackLine competitors available in the market, accounting teams can start for free with close management basics. With Numeric Essentials, the free plan, teams have access to all the close management basic features in addition to Numeric’s AI technical accounting co-pilot. To get started, accounting functions simply upload their existing financial close checklist.

Bottom Line

BlackLine can be a good fit for large, often public companies and multinational organizations that use SAP or a similar ERP and that require a high level of customization. It is important that these enterprises have a full-time BlackLine administrator or can afford potential ongoing professional services.

For such companies, the BlackLine pricing model includes both recurring subscription fees and one-time professional fees. The cost of the close management product is customizable and depends on the needed tools and the number of users. Generally speaking, BlackLine tends to skew more expensive than competitors.

Companies that need access to extensive flexibility and reporting but cannot afford dedicated staff and or the cost of BlackLine, can check out Numeric, getting started with a faster monthly close for free.

.png)

.png)

.png)